EverFi Answers Module 1 is your gateway to understanding the basics of financial literacy in a way that’s engaging and practical. Imagine diving into a world where you not only learn about money but also how to manage it effectively. This isn’t just another boring lesson; it’s an interactive experience designed to equip you with essential skills for life. Whether you’re a student, a young professional, or someone looking to brush up on their financial knowledge, EverFi has got your back. So, buckle up because we’re about to break down everything you need to know!

Now, let’s be honest here—most of us didn’t grow up with a personal finance class in school. That’s why EverFi steps in to fill that gap. Their modules are crafted to make learning about money as easy as pie. Module 1, in particular, lays the foundation by covering the basics of budgeting, saving, and understanding credit. It’s like the appetizer before the main course, but trust me, it’s packed with flavor.

What makes EverFi Answers Module 1 stand out is its approachable and interactive design. It’s not just about reading boring texts; it’s about engaging with quizzes, videos, and real-life scenarios that make the learning experience memorable. So, if you’re ready to take control of your financial future, let’s dive into the nitty-gritty of what this module has to offer.

- Nat Wolff Girlfriend Now The Full Story You Need To Know

- Bargatze Wife The Untold Story Of Love Fame And Family

What Exactly is EverFi and Why Should You Care?

Alright, let’s rewind a bit and talk about EverFi itself. EverFi isn’t just some random platform; it’s a powerhouse in the world of financial education. Founded with the mission to empower people with the knowledge they need to succeed in life, EverFi offers a range of courses covering topics from financial literacy to workplace ethics. But why should you care? Well, because financial literacy isn’t just a nice-to-have skill—it’s a need-to-have skill. Think about it: money touches every aspect of our lives, from buying groceries to planning for retirement. Understanding how it works can make a world of difference.

EverFi’s approach is what sets it apart. They don’t just throw numbers and terms at you; they break things down into bite-sized pieces that are easy to digest. Plus, their interactive modules keep things interesting. It’s like having a personal finance tutor but way cooler.

Breaking Down EverFi Answers Module 1

Now that we’ve established what EverFi is, let’s zoom in on Module 1. This module is all about the fundamentals. It covers everything from setting financial goals to understanding the importance of saving. Think of it as the foundation of a house—without it, everything else would crumble. The module is divided into several key sections, each focusing on a different aspect of financial literacy.

- What Star Sign Is May 22nd Discover Your Zodiac And Unlock Its Secrets

- Unlocking The Secrets Of Academia Path Your Ultimate Guide To Success

Setting Financial Goals

One of the first things you’ll learn in Module 1 is how to set realistic financial goals. This isn’t just about saying, “I want to be rich.” It’s about creating specific, measurable, and achievable objectives. For example, instead of saying, “I want to save money,” you might say, “I want to save $500 in the next six months.” This approach makes it easier to track your progress and stay motivated.

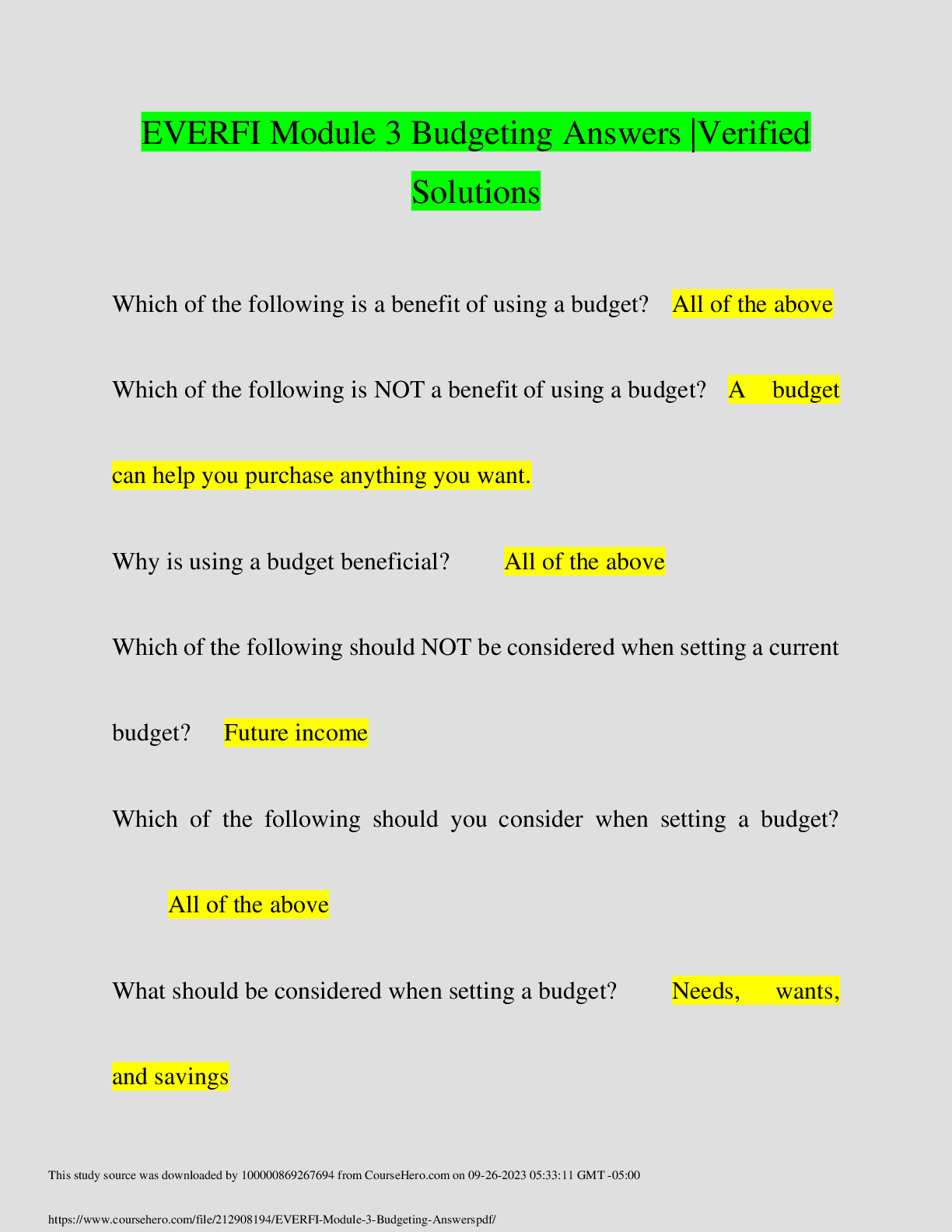

Budgeting 101

Budgeting is the cornerstone of financial health, and Module 1 doesn’t shy away from teaching you the basics. You’ll learn how to create a budget that works for you, taking into account your income, expenses, and savings goals. It’s like giving your money a job, so it knows exactly where to go and what to do.

Understanding Credit: The Good, the Bad, and the Ugly

Credit is one of those topics that can be both a blessing and a curse. In Module 1, you’ll learn how credit works, including how to build good credit and avoid falling into debt traps. Think of credit as a powerful tool—if used wisely, it can help you achieve your financial goals. But if misused, it can lead to financial ruin. EverFi breaks down the complexities of credit into simple terms, making it easier to understand and manage.

Building Good Credit

Building good credit is like building a reputation—it takes time and effort. Module 1 provides practical tips on how to improve your credit score, such as paying bills on time and keeping your credit utilization low. These small steps can make a big difference in the long run.

Avoiding Debt Traps

On the flip side, Module 1 also warns against common debt traps that many people fall into. From high-interest credit cards to predatory loans, the module highlights the dangers of mismanaging credit. It’s like having a warning sign that says, “Beware of the financial pitfalls ahead.”

Saving: The Key to Financial Stability

Saving is another crucial aspect covered in Module 1. You’ll learn why it’s important to have an emergency fund and how to save for long-term goals like buying a house or retiring comfortably. Saving isn’t just about cutting corners; it’s about creating a safety net for the future.

Creating an Emergency Fund

An emergency fund is like your financial parachute—it’s there to catch you when things go wrong. Module 1 explains how to start building an emergency fund, even if you’re on a tight budget. It’s all about prioritizing and making smart choices.

Saving for Long-Term Goals

Whether you’re saving for a dream vacation, a new car, or retirement, Module 1 provides strategies to help you reach your goals. It’s like having a roadmap that guides you toward financial freedom.

Interactive Features: What Makes EverFi Unique

One of the things that makes EverFi stand out is its interactive features. Unlike traditional learning methods, EverFi uses quizzes, videos, and real-life scenarios to make the learning experience engaging. It’s like having a game where you’re not just passively absorbing information but actively participating in your education.

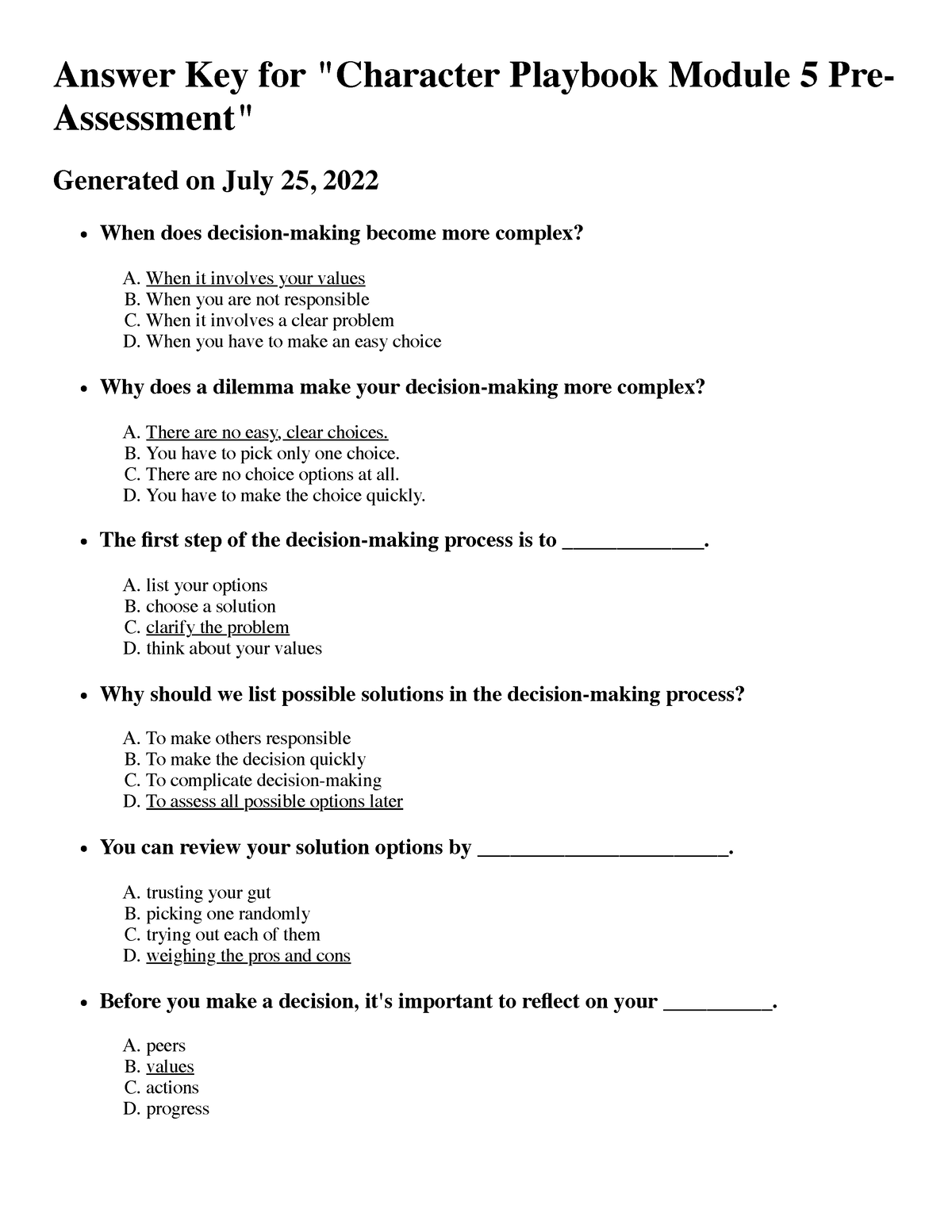

Quizzes and Assessments

Quizzes are a great way to test your knowledge and reinforce what you’ve learned. Module 1 includes several quizzes that challenge you to apply the concepts you’ve learned. It’s like a mini-challenge that keeps you on your toes.

Real-Life Scenarios

Real-life scenarios are another powerful tool used in Module 1. By putting you in situations that mimic real-world challenges, the module helps you develop practical skills that you can apply in your own life. It’s like practicing for the real thing, so when you encounter similar situations, you’re ready to handle them with confidence.

Why Financial Literacy Matters

Now, let’s take a step back and talk about why financial literacy matters. In today’s world, where financial decisions can have a lasting impact on your life, understanding how money works is more important than ever. Financial literacy isn’t just about knowing how to balance a checkbook; it’s about having the knowledge and skills to make informed decisions about your money.

The Impact of Financial Literacy

Studies have shown that people who are financially literate are more likely to save for retirement, manage debt effectively, and make sound investment decisions. In fact, according to a report by the National Endowment for Financial Education, individuals who are financially literate are more likely to achieve financial stability and security. It’s like having a superpower that helps you navigate the complexities of modern life.

The Cost of Financial Illiteracy

On the flip side, financial illiteracy can have serious consequences. People who lack financial knowledge are more likely to fall into debt, make poor investment decisions, and struggle to achieve their financial goals. It’s like driving a car without knowing how to read a map—you might get somewhere, but it’s going to be a bumpy ride.

How to Get the Most Out of EverFi Answers Module 1

Now that you know what EverFi Answers Module 1 has to offer, let’s talk about how to get the most out of it. Here are a few tips to help you maximize your learning experience:

- Take your time—don’t rush through the module. The more you absorb, the more you’ll retain.

- Engage with the interactive features. Quizzes and real-life scenarios are there to help you, so don’t skip them.

- Apply what you’ve learned to your own life. The best way to solidify your knowledge is to put it into practice.

- Ask questions. If something doesn’t make sense, don’t hesitate to reach out for clarification.

Conclusion: Take Control of Your Financial Future

In conclusion, EverFi Answers Module 1 is a powerful tool for anyone looking to improve their financial literacy. It covers the basics of budgeting, saving, and understanding credit in a way that’s engaging and practical. By mastering these fundamentals, you’ll be well on your way to achieving financial stability and security.

So, what are you waiting for? Dive into Module 1 and take the first step toward financial empowerment. And don’t forget to share your thoughts and experiences in the comments below. We’d love to hear how EverFi is helping you take control of your financial future!

Table of Contents

- What Exactly is EverFi and Why Should You Care?

- Breaking Down EverFi Answers Module 1

- Understanding Credit: The Good, the Bad, and the Ugly

- Saving: The Key to Financial Stability

- Interactive Features: What Makes EverFi Unique

- Why Financial Literacy Matters

- How to Get the Most Out of EverFi Answers Module 1

- Conclusion: Take Control of Your Financial Future

- Why Dominos Brooklyn Style Pizza Is A Game Changer For Pizza Lovers

- Riley Reed Married The Ultimate Guide To Her Love Life Career And More