Ever wondered how much of your hard-earned cash actually lands in your pocket after taxes and deductions? Well, buckle up because we're diving deep into the world of California paycheck calculators! Whether you're a newbie to the Golden State or a seasoned resident, understanding how your paycheck works is crucial. And guess what? You’re in the right place. In this article, we’ll break down everything you need to know about California paycheck calculators, from the basics to the nitty-gritty details.

Let’s face it, salary calculations can be overwhelming, especially when you’re dealing with state-specific rules like those in California. But don’t sweat it! By the end of this guide, you’ll have all the tools and knowledge to calculate your paycheck like a pro. We’ll cover everything from taxes to deductions and even throw in some tips to help you maximize your take-home pay.

Think of this as your cheat sheet to financial clarity. So, grab a coffee, sit back, and let’s decode the mystery of your paycheck together. Ready? Let’s dive in!

- Revolutionize Your Marketing Strategy With Redners Ads

- Tennessean Obituary A Heartfelt Journey Through Lifes Final Chapter

What is a California Paycheck Calculator?

A California paycheck calculator is essentially your go-to tool for figuring out exactly how much you’ll bring home after all the deductions and taxes. It’s like a magic wand for anyone trying to budget or plan their finances. Unlike other states, California has its own set of tax rules, which means using a generic paycheck calculator just won’t cut it.

This handy tool takes into account factors like federal and state taxes, Social Security, Medicare, and any additional deductions specific to California. It’s not just about numbers; it’s about understanding where your money goes and how much you actually get to keep. Whether you’re an hourly worker or a salaried employee, a paycheck calculator is your best friend when it comes to financial planning.

Why Use a Paycheck Calculator?

Using a paycheck calculator isn’t just about curiosity. It’s about taking control of your finances. Here’s why you should consider using one:

- Payton Pritchard Wife The Untold Story Behind The Nba Stars Love Life

- Harold Poole Funeral Service A Heartfelt Tribute To A Legacy

- Accurate Budgeting: Knowing exactly how much you’ll take home helps you plan your expenses better.

- Tax Preparation: Understanding your tax obligations can save you from surprises during tax season.

- Financial Clarity: It gives you a clear picture of your financial health, helping you make informed decisions.

Think of it as a personal financial advisor that’s available 24/7 and doesn’t charge a dime!

Understanding California Tax Laws

Before we dive deeper into paycheck calculations, it’s important to understand the tax landscape in California. The state has one of the highest income tax rates in the country, so it’s crucial to know what you’re dealing with.

Key Tax Considerations

Here’s a quick rundown of the main taxes that affect your paycheck in California:

- State Income Tax: California’s state income tax ranges from 1% to 13.3% depending on your income bracket.

- Federal Income Tax: This is determined by your federal tax bracket and can vary significantly based on your earnings.

- Social Security Tax: A flat rate of 6.2% up to a certain income limit.

- Medicare Tax: A flat rate of 1.45% with an additional 0.9% for higher earners.

These taxes are automatically deducted from your paycheck, but knowing the breakdown can help you understand your net pay better.

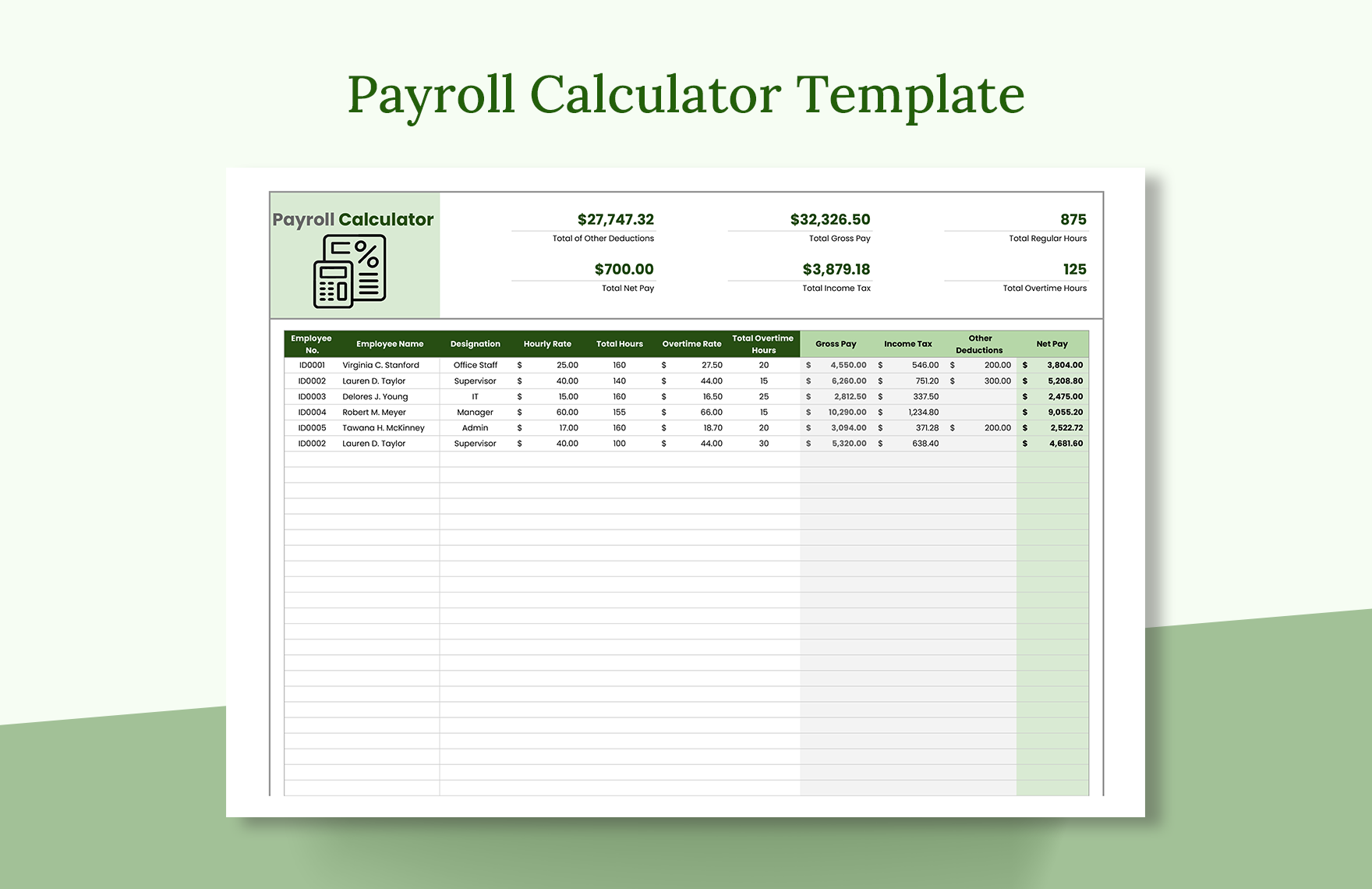

How Does a California Paycheck Calculator Work?

Now that you know the basics, let’s talk about how a paycheck calculator actually works. It’s pretty straightforward, but there are a few key steps involved:

- Input Your Information: Enter details like your gross pay, pay frequency, filing status, and any additional deductions.

- Calculate Deductions: The calculator will then compute all the necessary taxes and deductions based on the information you provided.

- View Your Results: Finally, you’ll get a detailed breakdown of your net pay, showing exactly how much you’ll take home.

It’s like having a personal accountant at your fingertips, minus the hefty fees!

Common Deductions in California Paychecks

Besides taxes, there are several other deductions that might appear on your paycheck. Here’s a list of the most common ones:

- Health Insurance: Premiums for employer-provided health insurance.

- Retirement Contributions: Contributions to 401(k) or other retirement plans.

- Disability Insurance: California requires employees to contribute to the State Disability Insurance (SDI) program.

- Union Dues: If you’re part of a union, these fees will be deducted from your paycheck.

These deductions can add up, so it’s important to factor them into your calculations.

Factors Affecting Your Net Pay

Your net pay isn’t just determined by your gross salary. Several factors can influence how much you actually take home. Here are some of the main ones:

1. Pay Frequency

Are you paid weekly, bi-weekly, semi-monthly, or monthly? The frequency of your paychecks can affect your net pay, especially when it comes to deductions.

2. Filing Status

Whether you’re single, married filing jointly, or head of household can impact your tax liability and, consequently, your net pay.

3. Additional Income

If you have multiple sources of income, this can also affect your tax bracket and deductions.

Understanding these factors can help you get a more accurate picture of your take-home pay.

Using a California Paycheck Calculator Effectively

Now that you know the ins and outs of paycheck calculations, here are some tips for using a calculator effectively:

- Double-Check Your Inputs: Make sure you enter all the necessary information accurately to get the most accurate results.

- Compare Results: If you’re unsure about the accuracy of the calculator, try using a few different ones to see if the results match.

- Stay Updated: Tax laws and rates can change, so it’s important to use a calculator that’s regularly updated with the latest information.

Remember, the goal is to get as close to the real number as possible, so don’t hesitate to tweak your inputs until you’re satisfied with the results.

Common Mistakes to Avoid

Even with the best tools, mistakes can happen. Here are some common pitfalls to watch out for:

- Incorrect Filing Status: Entering the wrong filing status can lead to inaccurate tax calculations.

- Forgetting Deductions: Not accounting for all your deductions can give you a skewed view of your net pay.

- Using Outdated Calculators: Always use a calculator that’s up-to-date with the latest tax laws and rates.

Avoiding these mistakes will ensure you get the most accurate results possible.

Maximizing Your Take-Home Pay

So, how can you make the most of your paycheck? Here are a few strategies:

1. Optimize Your Tax Withholding

Make sure you’re withholding the right amount of taxes. Too much and you’re giving the government an interest-free loan; too little and you could face penalties.

2. Contribute to Tax-Advantaged Accounts

Maximizing contributions to accounts like 401(k)s or Health Savings Accounts (HSAs) can reduce your taxable income and increase your net pay.

3. Review Your Deductions Regularly

Things change, and so can your deductions. Regularly reviewing them can help you catch any discrepancies or opportunities to save money.

By implementing these strategies, you can ensure you’re taking home as much as possible.

Where to Find Reliable Paycheck Calculators

Not all paycheck calculators are created equal. Here are some reliable options to consider:

- Official State Resources: Check out the California Department of Tax and Fee Administration for official calculators and resources.

- Financial Websites: Websites like SmartAsset and ADP offer robust paycheck calculators tailored to California residents.

- Payroll Software: If you’re self-employed or run a business, consider using payroll software like Gusto or QuickBooks for accurate calculations.

Stick to reputable sources to ensure you’re getting accurate and up-to-date information.

Conclusion

Understanding your paycheck is more than just a numbers game; it’s about taking control of your financial future. With the help of a California paycheck calculator, you can demystify the process and make informed decisions about your money. Remember, knowledge is power, and the more you know about your paycheck, the better equipped you’ll be to manage your finances.

So, what are you waiting for? Grab that paycheck calculator and start crunching those numbers. And don’t forget to share this article with your friends and family. Knowledge is power, and the more people who understand their paychecks, the better off we all are!

Table of Contents

- What is a California Paycheck Calculator?

- Why Use a Paycheck Calculator?

- Understanding California Tax Laws

- How Does a California Paycheck Calculator Work?

- Common Deductions in California Paychecks

- Factors Affecting Your Net Pay

- Using a California Paycheck Calculator Effectively

- Common Mistakes to Avoid

- Maximizing Your Take-Home Pay

- Where to Find Reliable Paycheck Calculators

- Dr Moumita Deb Nath The Rising Star In Medical Innovation

- Inside The X Andy Cohen Leak The Untold Story You Need To Hear