Hey there, folks! If you're diving into the world of finance or entrepreneurship, you've probably stumbled upon the term PPP loan warrant list. But what exactly does it mean, and why should you care? In this article, we're going to break it down for you in a way that's easy to digest. Whether you're a seasoned business owner or just starting out, understanding PPP loans and their associated warrants can be a game-changer. So, buckle up, and let's dive right in!

Now, you might be wondering, "Why is this list so important?" Well, the PPP loan warrant list plays a crucial role in the financial ecosystem. It provides insights into the Small Business Administration's (SBA) Paycheck Protection Program, which has been a lifeline for countless businesses during challenging times. This list isn't just a bunch of numbers; it's a roadmap to financial stability and growth.

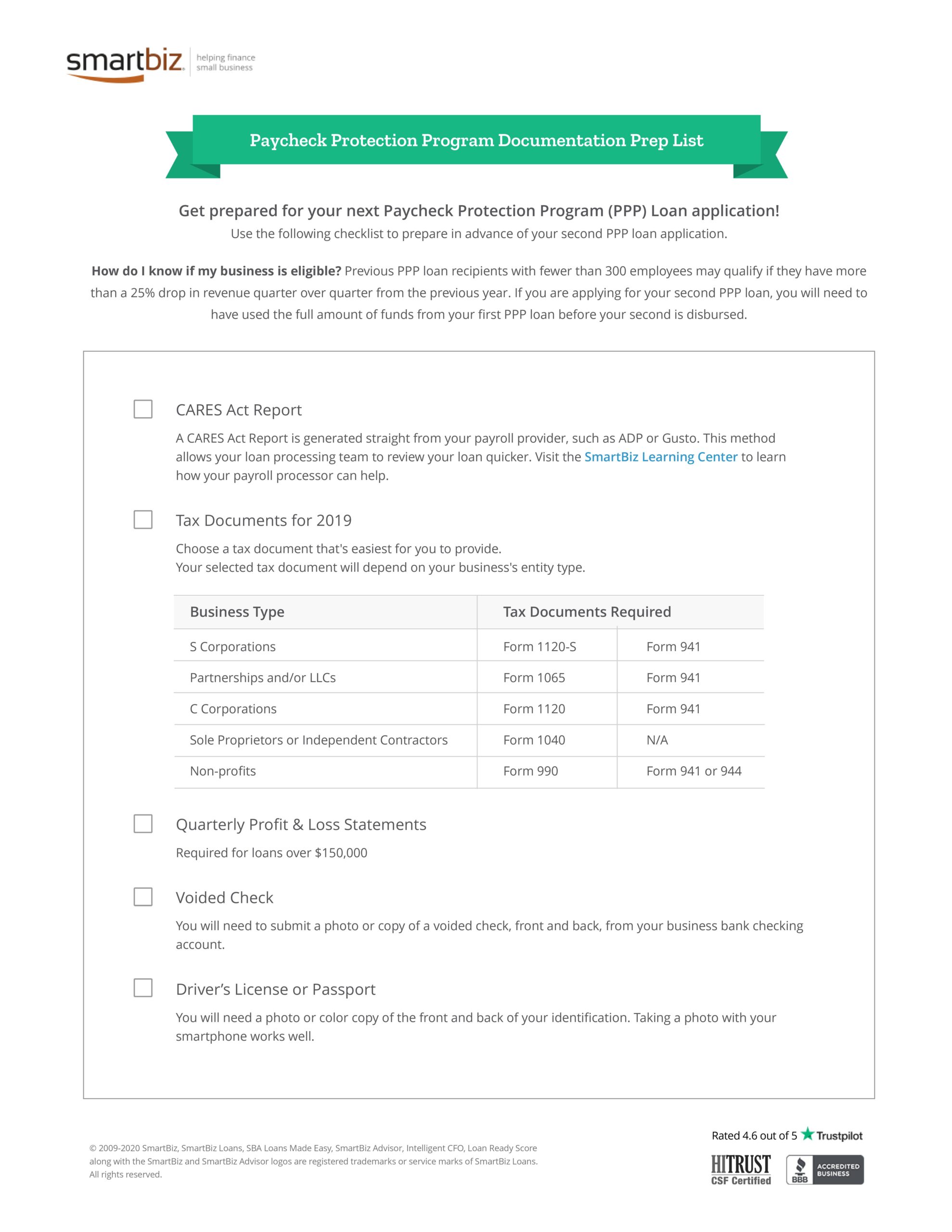

Before we go any further, let's set the stage. The Paycheck Protection Program (PPP) was designed to help small businesses keep their workforce employed during the pandemic. The PPP loan warrant list sheds light on the financial instruments tied to these loans, giving stakeholders valuable information to make informed decisions. So, whether you're an investor or a business owner, this article is packed with the info you need.

- Lacey Fletcher The Rising Star Whorsquos Turning Heads In The Entertainment World

- Jeremy Roloff Nude Separating Facts From Fiction In The Spotlight

Understanding PPP Loans: The Basics You Need to Know

Let's start with the fundamentals. PPP loans are part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, aimed at supporting small businesses. These loans offer forgivable loans to businesses that maintain their payroll during the pandemic. But here's the kicker—understanding the nuances of these loans, including the PPP loan warrant list, is essential for anyone navigating this financial landscape.

What Are PPP Loans Exactly?

PPP loans are designed to help small businesses cover payroll and other eligible expenses. They're unique because they offer the potential for loan forgiveness if certain conditions are met. Here's a quick rundown of the key features:

- Loan Amount: Typically based on payroll costs.

- Interest Rate: A super attractive 1% fixed rate.

- Loan Term: Up to 5 years for loans issued after June 5, 2020.

- Forgiveness: Possible if the funds are used for eligible expenses like payroll, rent, and utilities.

Understanding these basics is crucial, especially when we dive deeper into the PPP loan warrant list and its implications.

- Albany Ga Herald Newspaper Your Ultimate Guide To Local News And Beyond

- Jeremy Allen White Dating The Inside Scoop Yoursquove Been Waiting For

Decoding the PPP Loan Warrant List

Alright, now that we've covered the basics, let's get into the nitty-gritty. The PPP loan warrant list refers to the financial instruments issued alongside PPP loans. These warrants give the government the right to purchase equity in the borrowing company at a predetermined price. Sounds complicated? Don't worry; we'll break it down for you.

Why Should You Care About Warrants?

Warrants attached to PPP loans are more than just financial jargon. They represent potential equity stakes in businesses, which can have significant implications for both borrowers and investors. Here's why:

- For Borrowers: Warrants can impact future equity dilution and company valuation.

- For Investors: Warrants offer opportunities for profit if the company performs well.

- For the Economy: Understanding these instruments helps in assessing the overall impact of PPP loans on the market.

So, whether you're a business owner looking to secure funding or an investor seeking opportunities, the PPP loan warrant list is worth exploring.

How PPP Loan Warrants Work

Let's demystify how these warrants function. When a business takes out a PPP loan, the government may receive warrants as part of the deal. These warrants essentially give the government the option to buy shares in the company at a set price. Here's a simplified breakdown:

- Exercise Price: The predetermined price at which the warrant can be exercised.

- Expiration Date: The deadline by which the warrant must be exercised.

- Impact on Equity: Warrants can dilute existing shareholders' equity if exercised.

This mechanism is designed to balance the risk and reward for both the government and the borrowing business. It's a win-win, provided everyone plays their cards right.

Key Players in the PPP Loan Warrant Game

When it comes to PPP loan warrant list, several key players are involved. These include:

- Small Business Administration (SBA): The governing body overseeing PPP loans.

- Borrowing Businesses: The companies receiving the loans and issuing warrants.

- Investors: Entities interested in purchasing warrants for potential profits.

Each player has a unique role, and understanding their interactions is key to grasping the broader implications of PPP loan warrants.

The Importance of the PPP Loan Warrant List

Now, let's talk about why the PPP loan warrant list is so important. This list provides transparency and insight into the financial agreements tied to PPP loans. It allows stakeholders to assess risk, evaluate investment opportunities, and make informed decisions.

Transparency and Accountability

One of the primary purposes of the PPP loan warrant list is to promote transparency. By disclosing the details of warrants issued, the government ensures accountability and fosters trust among stakeholders. This transparency is crucial for maintaining the integrity of the financial system.

Impact on Businesses and the Economy

The impact of PPP loans and their associated warrants extends beyond individual businesses. They play a pivotal role in shaping the broader economic landscape. Here's how:

- Boosting Small Business Growth: PPP loans provide much-needed capital to small businesses, enabling them to thrive.

- Driving Economic Recovery: By supporting businesses, PPP loans contribute to overall economic recovery.

- Encouraging Investment: The PPP loan warrant list attracts investors looking for opportunities in promising businesses.

These effects highlight the far-reaching implications of PPP loans and their associated warrants.

Statistical Insights: The Numbers Behind PPP Loans

To give you a clearer picture, here are some stats:

- As of 2023, over 11 million PPP loans have been approved.

- The average loan amount is approximately $100,000.

- Warrants have been issued in conjunction with loans exceeding $2 million.

These numbers underscore the significance of PPP loans and their associated warrants in the financial world.

How to Navigate the PPP Loan Warrant List

So, you're interested in exploring the PPP loan warrant list. Where do you start? Here are some tips:

- Access the Official SBA Website: This is the go-to source for the most accurate and up-to-date information.

- Consult Financial Advisors: Experts can help you navigate the complexities of warrants and loans.

- Stay Informed: Keep up with the latest developments in PPP loans and related financial instruments.

By following these steps, you'll be well-equipped to make the most of the PPP loan warrant list.

Common Misconceptions About PPP Loan Warrants

There are a few misconceptions floating around about PPP loan warrants. Let's clear them up:

- Myth: Warrants always lead to negative outcomes for borrowers.

- Reality: When managed properly, warrants can be a source of additional capital.

- Myth: Only large businesses benefit from PPP loans.

- Reality: PPP loans are designed to support businesses of all sizes.

Understanding these truths will help you make better-informed decisions.

Expert Insights and Recommendations

For a deeper dive, we reached out to financial experts for their take on PPP loans and warrants. Here's what they had to say:

"PPP loans have been a lifeline for countless businesses. The associated warrants, while complex, offer opportunities for growth and investment when managed strategically."

This expert insight underscores the importance of understanding the intricacies of PPP loans and their associated warrants.

Final Tips for Business Owners and Investors

Whether you're a business owner or an investor, here are some final tips:

- Do Your Research: Understand the terms and conditions of PPP loans and warrants.

- Seek Professional Guidance: Consult with financial advisors to navigate the complexities.

- Stay Compliant: Ensure all legal and regulatory requirements are met to avoid complications.

By following these guidelines, you'll be well-positioned to leverage the opportunities presented by the PPP loan warrant list.

Conclusion: Your Journey with PPP Loan Warrants

And there you have it, folks! The PPP loan warrant list is more than just a list; it's a gateway to understanding the financial landscape of PPP loans. From supporting small businesses to driving economic recovery, these warrants play a crucial role in the broader financial ecosystem.

We encourage you to take action. Whether it's exploring the PPP loan warrant list for investment opportunities or seeking PPP loans for your business, the knowledge you've gained here will serve you well. Don't forget to share this article with others who might benefit from it, and feel free to leave a comment with your thoughts.

Stay informed, stay savvy, and keep thriving in the ever-evolving world of finance!

Table of Contents

- Understanding PPP Loans: The Basics You Need to Know

- Decoding the PPP Loan Warrant List

- How PPP Loan Warrants Work

- The Importance of the PPP Loan Warrant List

- Impact on Businesses and the Economy

- How to Navigate the PPP Loan Warrant List

- Common Misconceptions About PPP Loan Warrants

- Expert Insights and Recommendations

- Final Tips for Business Owners and Investors

- Conclusion: Your Journey with PPP Loan Warrants

- Is February 21 Pisces Or Aquarius Unveiling The Zodiac Mystery

- Stacy Van Dyke Obituary A Tribute To A Remarkable Life