So, you've probably heard the buzz around PPP loans, but what exactly does it mean? If you're running a small business or managing finances for your company, the PPP loan list is your golden ticket to surviving tough economic times. The Paycheck Protection Program (PPP) was created to help businesses keep their workforce employed during the pandemic and beyond. But hey, it's not just about getting money—it's about using it wisely and ensuring your business stays afloat. So, buckle up because we're diving deep into everything you need to know about the PPP loan list.

Now, you might be thinking, "Why should I care about a PPP loan list?" Well, here's the deal: if your business has been hit by financial challenges, this could be your lifeline. The PPP loan isn't just another loan; it's a program designed specifically to help small businesses recover and thrive. In this guide, we'll break it down for you in a way that's easy to understand, so you can make the most of it.

Let's not forget that the PPP loan list isn't just a random collection of names and numbers. It's a powerful tool that can help you navigate the complexities of business financing. Whether you're looking to apply for a PPP loan or want to ensure your business is eligible, this article will be your go-to resource. So, let's get started and explore the world of PPP loans together!

- Morgan Wallen Father The Untold Story Behind The Man Shaping Country Music

- Claire Kittle Wife The Fascinating Story Behind The Woman In The Spotlight

What is the PPP Loan List Anyway?

Alright, let's start with the basics. The PPP loan list is essentially a comprehensive database of businesses that have received funding through the Paycheck Protection Program. This program was established by the U.S. Small Business Administration (SBA) in collaboration with the Department of the Treasury. The goal? To provide financial relief to small businesses affected by the pandemic.

But here's the kicker: the PPP loan list isn't just about who got the money. It's about transparency, accountability, and ensuring that funds are used for their intended purpose. The list includes details like the name of the business, the amount received, and sometimes even the industry they operate in. It's like a financial report card for businesses, and it's publicly available for anyone to see.

Why Should You Care About the PPP Loan List?

So, you might be wondering, "Why should I care about this list?" Well, there are a few reasons. First, if you're a small business owner, checking the PPP loan list can help you see how your peers are doing. Are they getting more funding than you? Are they using the money effectively? These are important questions to ask.

- Pics Of Jessica Caban A Deep Dive Into Her Journey And Iconic Moments

- How To Remove Wine Labels The Ultimate Guide For Wine Enthusiasts

Second, if you're a consumer or a stakeholder, the PPP loan list can give you insight into which businesses are prioritizing their employees and financial stability. It's like a sneak peek into the financial health of a company. Plus, it's always good to know where your money is going, right?

How Does the PPP Loan Program Work?

Now that we know what the PPP loan list is, let's dive into how the program actually works. The Paycheck Protection Program is designed to provide loans to small businesses with the potential for loan forgiveness. Yes, you heard that right—forgiveness. If you use the funds correctly, you might not have to pay them back. Sounds too good to be true? Let's break it down.

First, businesses apply for the PPP loan through approved lenders. Once approved, the funds are disbursed, and it's up to the business to use them wisely. The money can be used for payroll costs, rent, utilities, and other eligible expenses. But here's the catch: to qualify for loan forgiveness, businesses need to meet certain criteria, like maintaining employee headcount and using the funds for approved purposes.

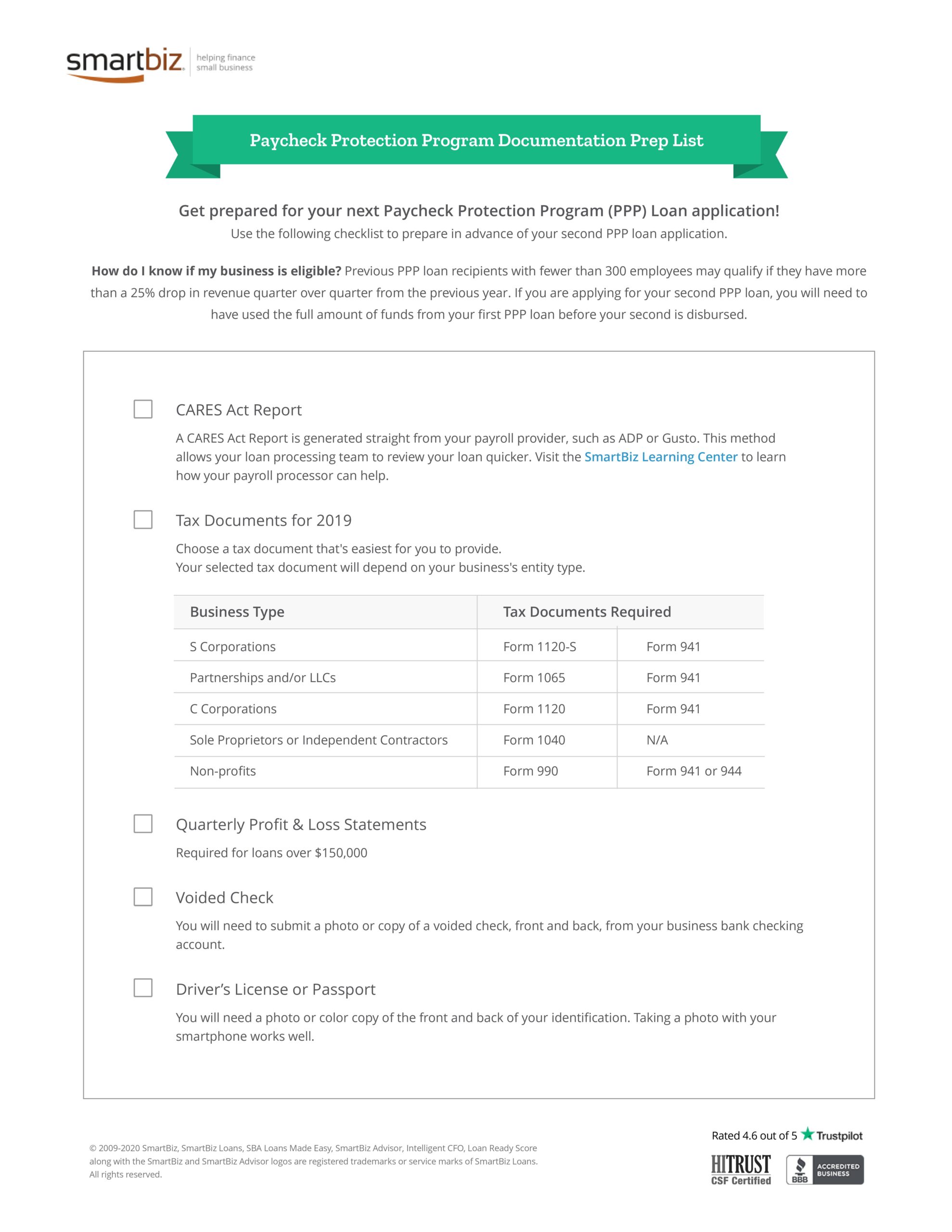

Eligibility Criteria for PPP Loans

Not every business qualifies for a PPP loan, so it's important to understand the eligibility criteria. Generally, businesses with fewer than 500 employees are eligible, but there are exceptions. For example, some industries have higher employee limits, and certain nonprofit organizations can also apply.

Here's a quick checklist to see if your business qualifies:

- Your business has fewer than 500 employees (or meets industry-specific limits).

- You were in operation on February 15, 2020.

- You have payroll expenses or other eligible costs.

- You can demonstrate economic need due to the pandemic.

Remember, the PPP loan program is designed to help businesses that are struggling, so if your business fits the criteria, don't hesitate to apply.

Understanding the PPP Loan Forgiveness Process

One of the most attractive features of the PPP loan program is the possibility of loan forgiveness. But how does it work? After receiving the loan, businesses have a specific period, usually 24 weeks, to use the funds. During this time, they need to ensure that at least 60% of the funds are spent on payroll costs. The remaining 40% can be used for rent, utilities, and other eligible expenses.

Once the covered period ends, businesses can apply for loan forgiveness by submitting the necessary documentation to their lender. This includes payroll records, proof of payment for eligible expenses, and other supporting documents. The lender will review the application and forward it to the SBA for final approval.

Common Mistakes to Avoid During the Forgiveness Process

Now, let's talk about some common mistakes businesses make during the forgiveness process. First, failing to maintain accurate records can lead to delays or even denial of forgiveness. Make sure you keep detailed records of all expenses and payroll costs.

Second, not understanding the forgiveness rules can also cause issues. For example, if you reduce employee headcount or salaries during the covered period, it could affect your forgiveness amount. So, it's crucial to stay informed and follow the guidelines closely.

Where to Find the PPP Loan List

Alright, so you're convinced that the PPP loan list is important, but where do you find it? The SBA regularly updates the PPP loan list on their official website. You can access it by visiting sba.gov. The list is organized by state and includes details like the business name, loan amount, and industry.

But here's a pro tip: don't just rely on the SBA website. There are also third-party platforms and tools that provide more detailed insights into the PPP loan list. Some even offer analytics and visualizations to help you make sense of the data. Just make sure the source is reputable and up-to-date.

How to Analyze the PPP Loan List

Once you have access to the PPP loan list, it's time to analyze the data. Start by looking at the businesses in your industry or location. Are they receiving more funding than you? Are they using the funds effectively? This can give you valuable insights into how to improve your own business practices.

Additionally, you can use the PPP loan list to identify trends and patterns. For example, are certain industries receiving more funding than others? Are businesses in urban areas getting more support than those in rural areas? These insights can help you understand the bigger picture and make informed decisions.

Benefits of the PPP Loan Program

Now, let's talk about the benefits of the PPP loan program. First and foremost, it provides much-needed financial relief to small businesses. With the funds, businesses can keep their employees on payroll, pay their rent, and cover other essential expenses. This not only helps businesses survive but also supports the overall economy.

Second, the potential for loan forgiveness is a huge advantage. Unlike traditional loans, PPP loans can be forgiven if used correctly. This reduces the financial burden on businesses and allows them to focus on growth and recovery.

Real-Life Success Stories

Let's take a look at some real-life success stories of businesses that benefited from the PPP loan program. One example is a small restaurant chain that used the funds to keep their employees on payroll and invest in new technology to enhance their online ordering system. Another example is a retail store that used the funds to pay rent and utilities while transitioning to an online sales model.

These stories show that the PPP loan program can make a real difference in the lives of business owners and their employees. It's not just about surviving—it's about thriving in challenging times.

Challenges and Criticisms of the PPP Loan Program

Of course, no program is perfect, and the PPP loan program has faced its fair share of challenges and criticisms. One of the main issues is the complexity of the application process. Many small business owners found it difficult to navigate the paperwork and meet the eligibility criteria.

Another criticism is the lack of transparency in the early stages of the program. Some businesses accused the SBA of favoring larger companies over smaller ones. However, the SBA has since made efforts to address these concerns and improve the program.

How to Overcome PPP Loan Program Challenges

If you're facing challenges with the PPP loan program, don't worry—you're not alone. Here are a few tips to help you overcome these obstacles:

- Seek guidance from a financial advisor or accountant who specializes in PPP loans.

- Use online resources and tools to simplify the application process.

- Stay informed about updates and changes to the program by following reliable news sources.

Remember, persistence is key. If you encounter roadblocks, don't give up. Keep pushing forward and seek help when needed.

Future of the PPP Loan Program

So, what does the future hold for the PPP loan program? While the initial rounds of funding have ended, there's always the possibility of additional rounds or similar programs in the future. The SBA and government officials are constantly evaluating the needs of small businesses and exploring ways to provide ongoing support.

In the meantime, it's important for businesses to focus on financial planning and sustainability. Even if the PPP loan program doesn't continue, there are other resources and programs available to help small businesses succeed.

Preparing for What's Next

To prepare for what's next, businesses should focus on building strong financial foundations. This includes creating a budget, managing cash flow, and exploring alternative funding options. Additionally, staying informed about industry trends and economic developments can help businesses anticipate future challenges and opportunities.

Remember, the PPP loan program was just one piece of the puzzle. To truly succeed, businesses need to adopt a holistic approach to financial management and strategic planning.

Conclusion: Take Action Today

So, there you have it—everything you need to know about the PPP loan list and program. From understanding the basics to navigating the forgiveness process, this guide has covered it all. But here's the most important takeaway: don't wait to take action. If your business qualifies for a PPP loan, apply today. If you're already a recipient, make the most of the funds and work towards loan forgiveness.

And remember, this isn't just about surviving—it's about thriving. Use the PPP loan program as a stepping stone to achieve your business goals and create a brighter future for yourself and your employees. So, what are you waiting for? Get out there and make it happen!

Call to Action: Share your thoughts and experiences with the PPP loan program in the comments below. Have you applied for a PPP loan? What challenges did you face? Let's start a conversation and help each other succeed!

Table of Contents

- PPP Loan List: Your Ultimate Guide to Understanding, Navigating, and Maximizing Benefits

- What is the PPP Loan List Anyway?

- Why Should You Care About the PPP Loan List?

- How Does the PPP Loan Program Work?

- Eligibility Criteria for PPP Loans

- Understanding the PPP Loan Forgiveness Process

- Common Mistakes to Avoid During the Forgiveness Process

- Where to Find the PPP Loan List

- How to Analyze the PPP Loan List

- Benefits of the PPP Loan Program

- Real-Life Success Stories

- Challenges and Criticisms of the PPP Loan Program

- How to Overcome PPP Loan Program Challenges

- Future of the PPP Loan Program

- Preparing for What's Next

- Conclusion: Take Action Today

- Dan Abrams First Wife The Untold Story Behind The Scenes

- Bargatze Wife The Untold Story Of Love Fame And Family